Unearned Revenues is what type of account? a Asset b. Liability c. Owner’s equity

Content

Landlords, companies that provide a subscription service, or those in the travel or hospitality industry may receive the majority of their payments for unearned revenue. As the business earns revenue, the unearned revenue balance is reduced with a debit, and the revenue account balance is increased with a credit. Unearned revenue is recognized and converted into earned revenue as products and services get delivered to the customer.

From a SaaS accounting perspective, you will not earn that revenue until you deliver what you sold to the customer. It means that the $12,000 deferred revenue turns into revenue gradually with each month as the subscription progresses. Then, at the end of each month, you can recognize revenue for that month with a journal entry. For instance, in is unearned revenue a current liability the United States, under the Securities and Exchange Commission, a public company must meet specific criteria for the revenue to be recognized as such. This criterion includes shifting delivery ownership, collection probability — a reasonable estimate of an amount for doubtful accounts — and evidence of an arrangement plus the determined price.

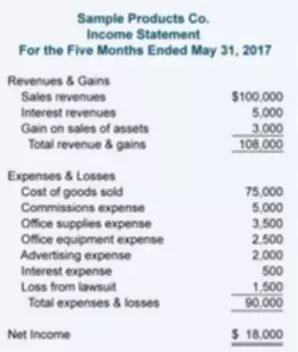

Journal Entries for Income Tax Expense

Since the customer may have the option to cancel their order, or the product or service may not get delivered for other reasons, the payment is considered a liability for the company receiving it. In any case where the customer doesn’t receive what they ordered, then the company would need to repay the customer. For deferred or unearned revenue, the customer pays in advance for goods or services that are provided later. Unearned revenue is any money received by a company for goods or services that haven’t been provided yet. It’s a buyer prepaying for something that will be supplied at some point in the future. Customer A takes you up on your offer and sends you an advance payment of $2,160 in January.

This investment in Norton Industries was valued at $21,500,000 on December 31, 2016. Brooks’ 12% ownership of Norton Industries has a current fair value of $22,225,000 on December 2017. Our mission is to empower readers with the most factual and reliable financial https://www.bookstime.com/ information possible to help them make informed decisions for their individual needs. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Connect With a Financial Advisor

There should be evidence of the arrangement, a predetermined price, and realistic delivery schedule. One-third of the total amount received belongs to the next accounting period. Therefore, only two-thirds of the unearned commission liability (3,600 × 0.66) will be converted into commission revenue at the end of the accounting period. Companies using the accrual method can make use of unearned revenue to help align income with costs and potentially defer income taxes until later periods when revenue has been earned. If the product or service is delivered incrementally instead of all at once, then revenue should be recognized equal to the amount of goods being exchanged.

Unearned revenue is the money received by the company or an individual for the service or product that has to be rendered or delivered yet. A common issue with businesses is accounting for unearned revenues. Unearned revenue is a key metric for investors to watch, as it can provide valuable insight into a company’s potential future revenue.

Is Unearned Revenue a Current Liability?

Consumers, meanwhile, generate deferred revenue as they pay upfront for an annual subscription to the magazine. A publishing company may offer a yearly subscription of monthly issues for $120. This means the business earns $10 per issue each month ($120 divided by 12 months). When you receive unearned revenue, it means you have taken up front or pre-payments before the actual delivery of products or services, making it a liability.

When a customer pays for products or services in advance of their receipt, this payment is recorded by a business as unearned revenue. Also referred to as “advance payments” or “deferred revenue,” unearned revenue is mainly used in accrual accounting. Due to the advanced nature of the payment, the seller has a liability until the good or service has been delivered. As a result, for accounting purposes the revenue is only recognized after the product or service has been delivered, and the payment received. The person receives the money from one party for which the goods have been delivered, or the services have been rendered to the party.

How Does the Cash Flow Statement Show If the Company Made Cash or Not?

For example, getting paid upfront means you don’t need to chase up customers for overdue invoices or wonder when you’re going to receive the money. ProfitWell Recognized allows you to minimize and even eliminate human errors resulting from manual balance sheet entries. Businesses, large and small alike, must ensure their bookkeeping practices comply with accounting standards like GAAP.

Is unearned revenue a current liability or asset?

Unearned revenue is recorded on a company's balance sheet as a liability. It is treated as a liability because the revenue has still not been earned and represents products or services owed to a customer.

Recent Comments